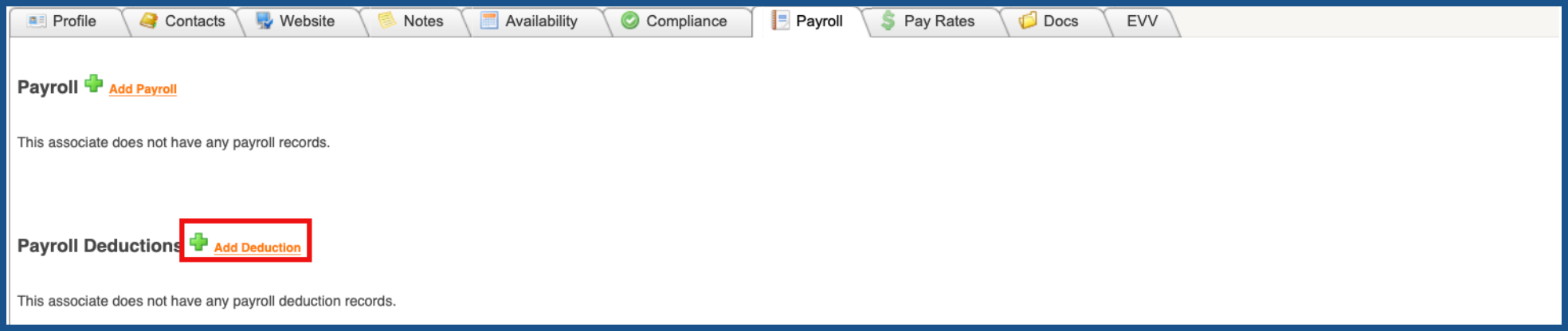

ADD DEDUCTION (Top)

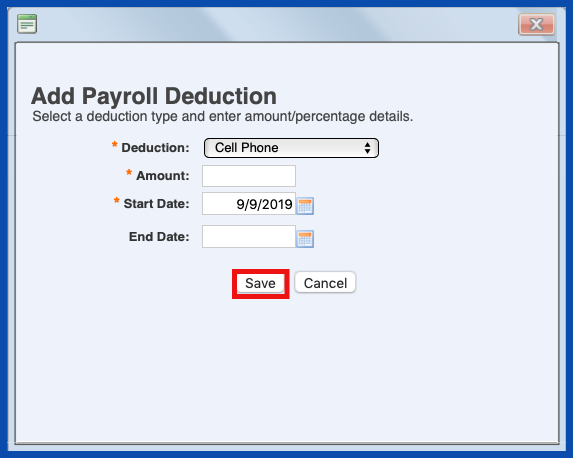

To add a payroll deduction, click on the "Add Deduction" link.

NOTE: For Careficient Agency Administrators, click here to learn more about setting up Deductions in the lookup tables. Click here to learn more about the privileges for Add Deductions.

Enter the required information and click "Save" when finished.

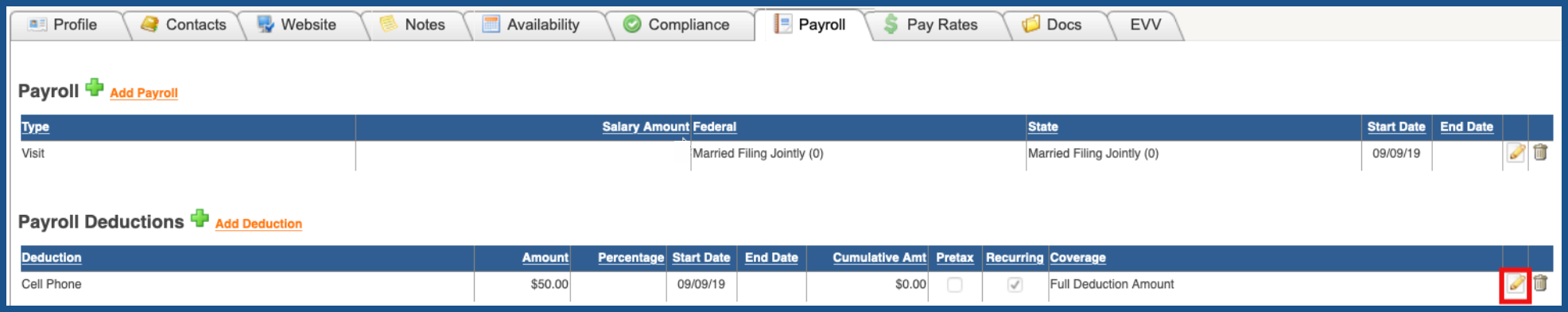

EDIT DEDUCTION (Top)

To edit a payroll deduction, click on the "Edit" pencil, make the required changes and click "Save" when finished.

NOTE: For Careficient Agency Administrators, click here to learn more about the privileges for Edit Deductions.

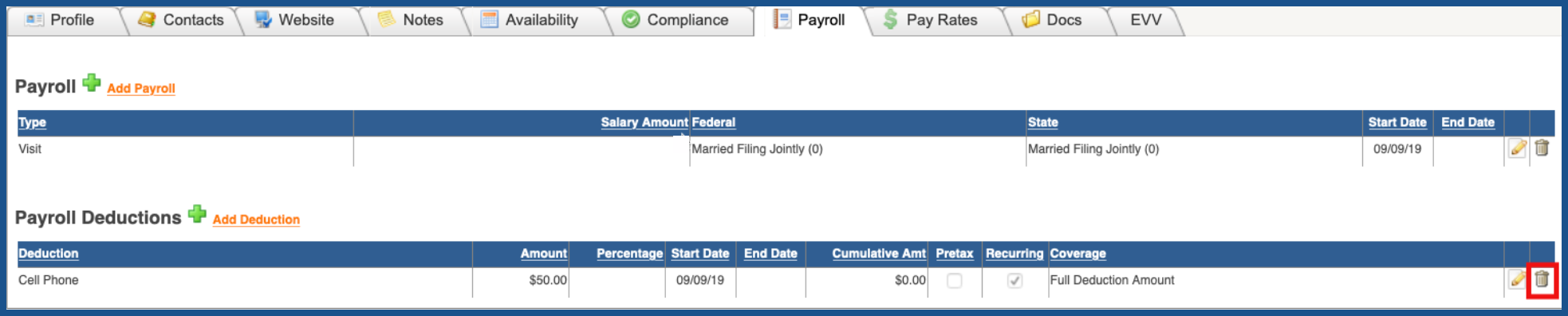

DELETE DEDUCTION (Top)

To delete a payroll deduction, click on the "Trash Can".

NOTE: For Careficient Agency Administrators, click here to learn more about the privileges for Delete Deductions.