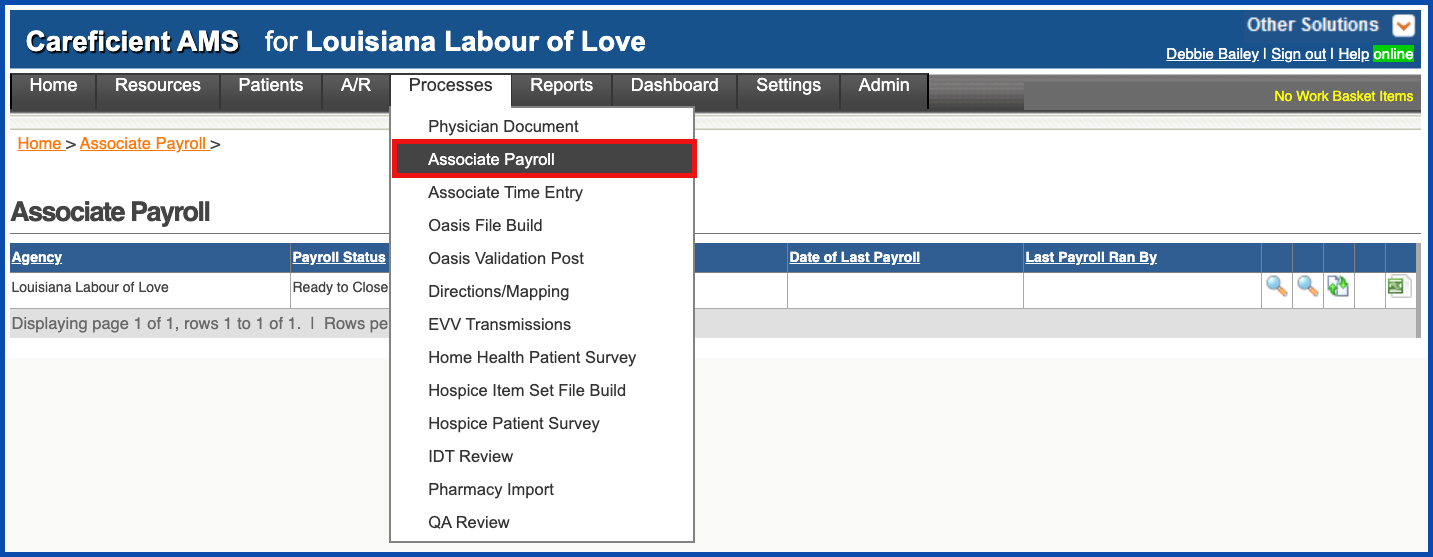

ASSOCIATE PAYROLL

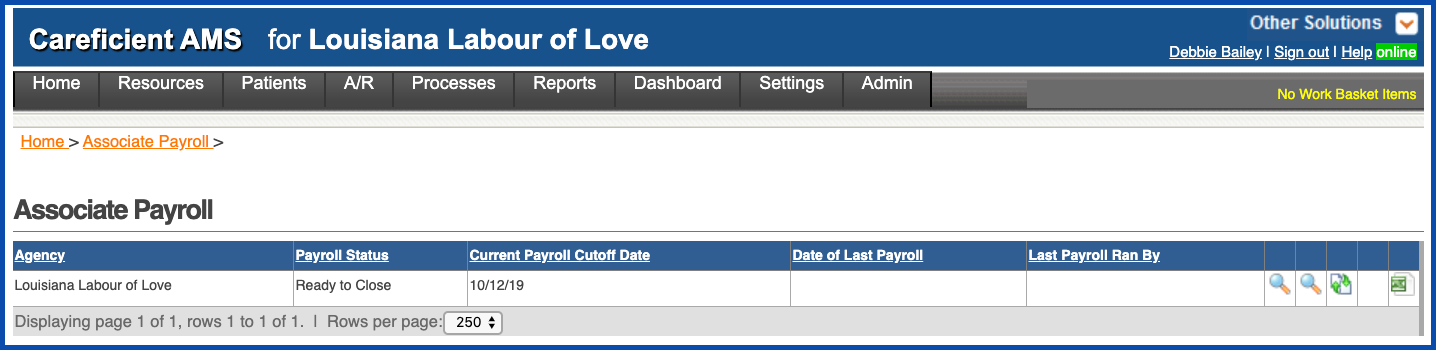

Payroll data and records are created in the system as part of the Verify Services process. This process allows you to generate associate payroll information. The Associate Payroll module lets you review all payroll transactions prior to closing the payroll process for a particular time cycle.

NOTE: For Careficient Agency Administrators, click on the following to learn more about the privileges for View Payroll, and Close Payroll.

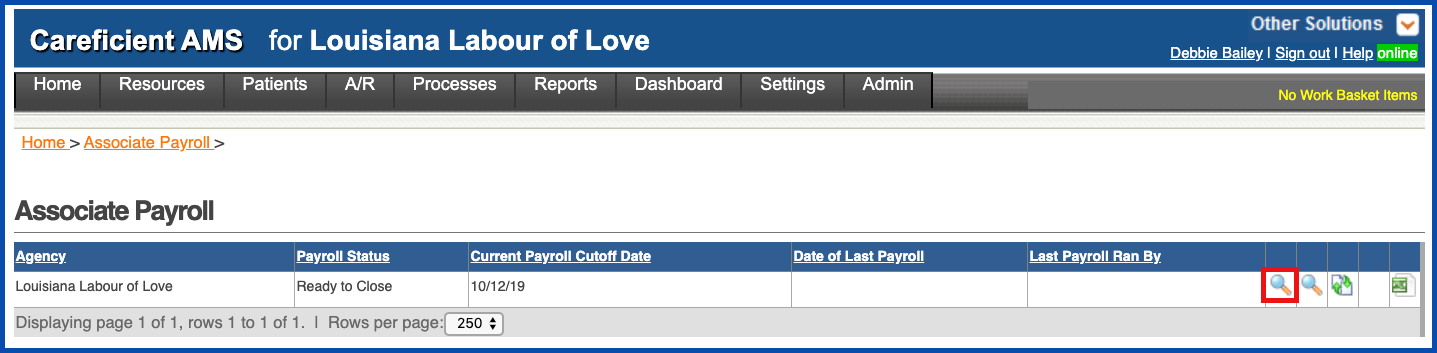

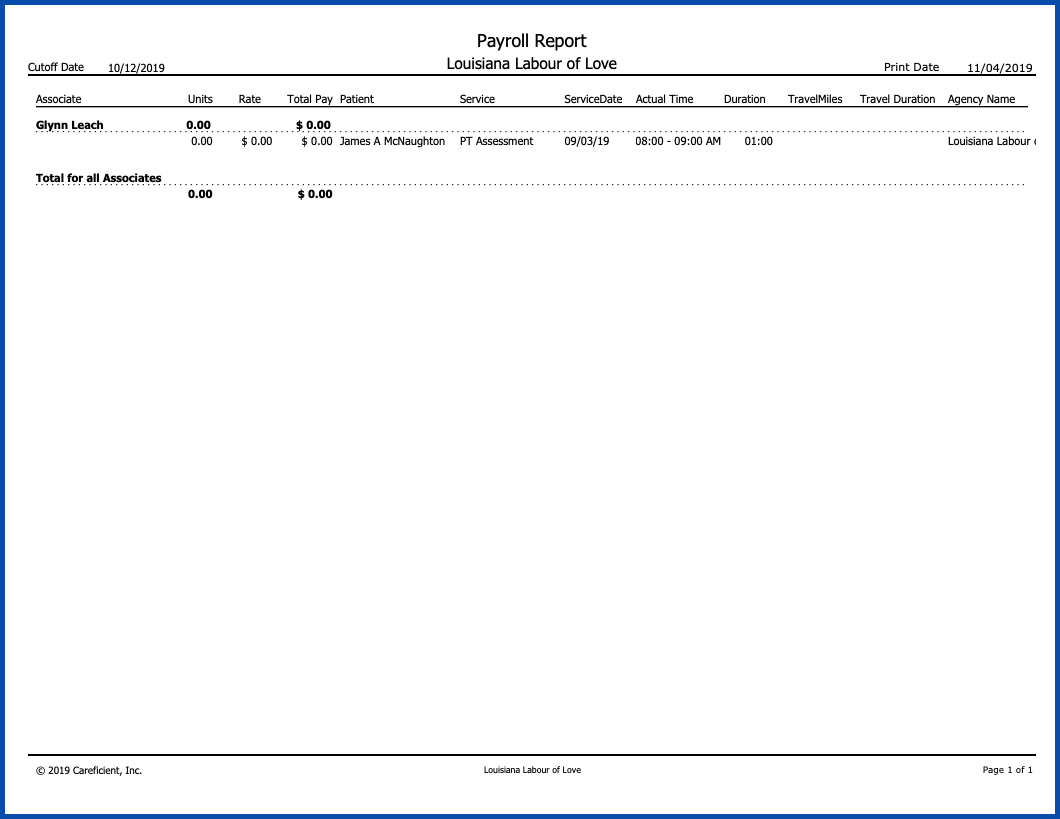

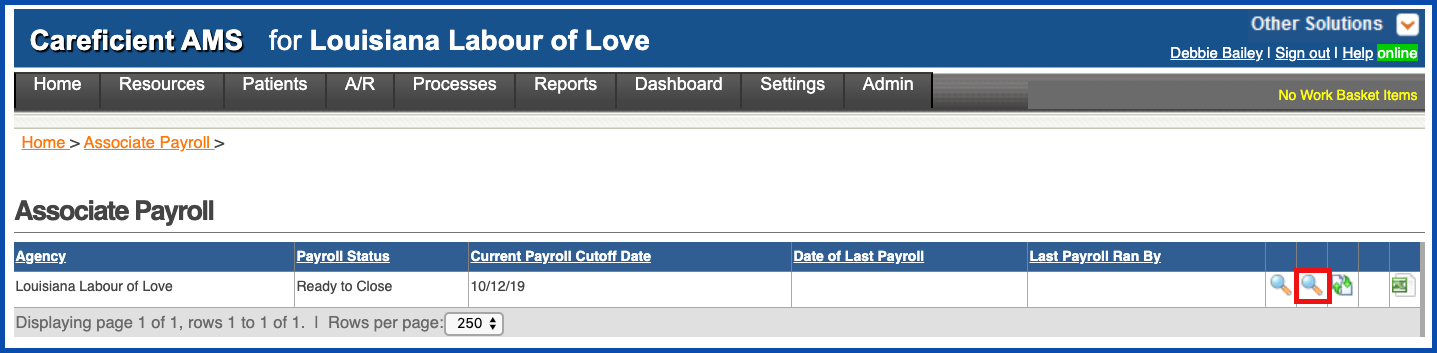

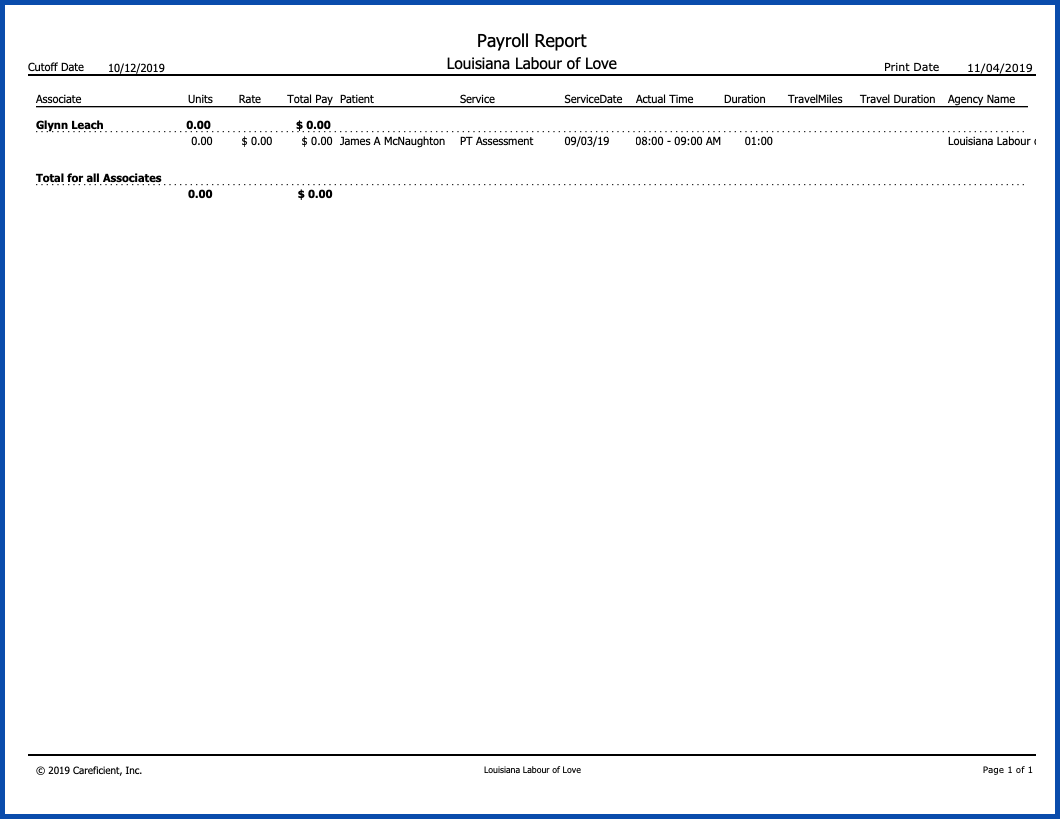

The View Payroll Transactions icon is a link to view payroll transactions for time periods that have not yet closed. Click the magnifying glass to display the Payroll Report, which is an alphabetical listing of all associates with pay records that have been verified for a specific time period. Information on the Payroll Report is used by your organization to create the actual pay records for the associates listed. Your organization will use the gross pay amounts provided in this report to calculate federal and state income tax and apply other deductions to the gross pay. This determines the actual pay amount that the associate will receive. There may be items displayed in red below the payroll detail for each associate. These entries are for deductions that have been set up for the associate and which reduce their pay when your organization processes their payroll.

Preview of Payroll Transactions Report

The Payroll Transactions Report includes:

- Cutoff Date

- Associate

- Units

- Rate

- Total Pay

- Patient

- Service

- Service Date

- Actual Time

- Duration

- Travel Miles

- Travel Duration

- Agency Name

- Total for all Associates in Units

- Total for all Associates in Total Pay

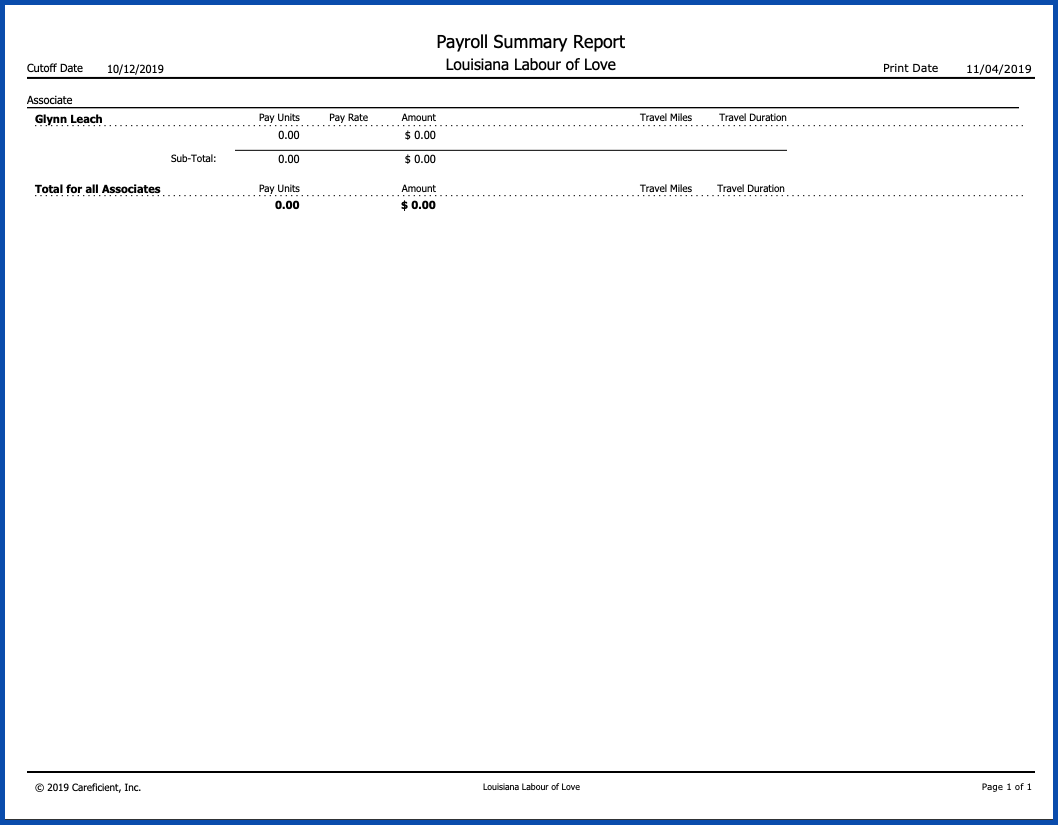

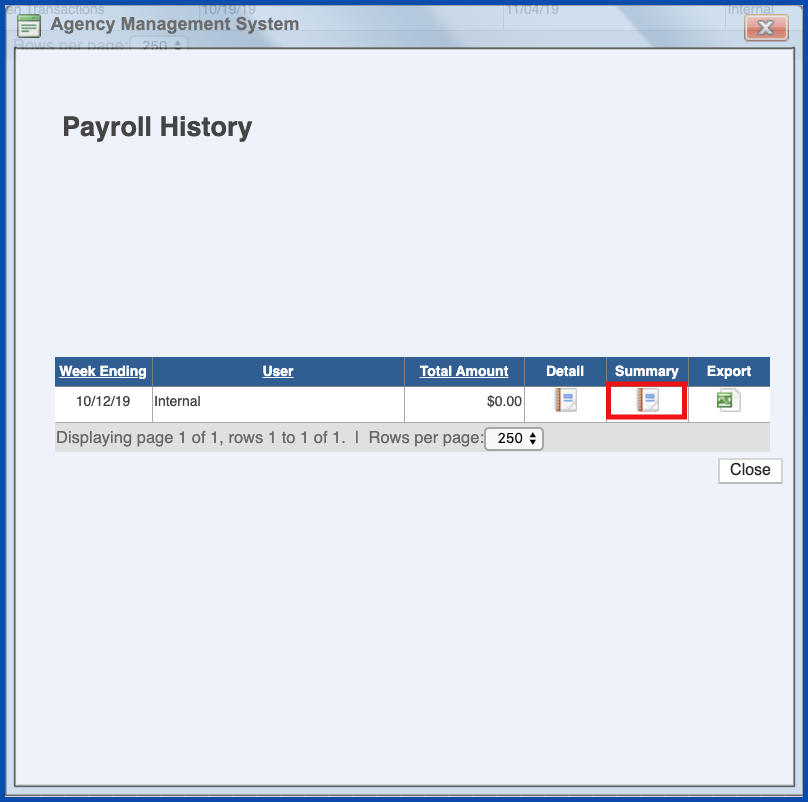

To view the Payroll Summary Report, click on the View Payroll Summary icon.

Preview of Payroll Summary Report

Payroll Summary Report includes:

- Cutoff Date

- Associate

- Pay Units

- Pay Rate

- Amount

- Travel miles

- Travel Duration

- Total for all Associates in Pay Units

- Total for all Associates in Amount

- Total for all Associates in Travel Miles

- Total for all Associates in Travel Duration

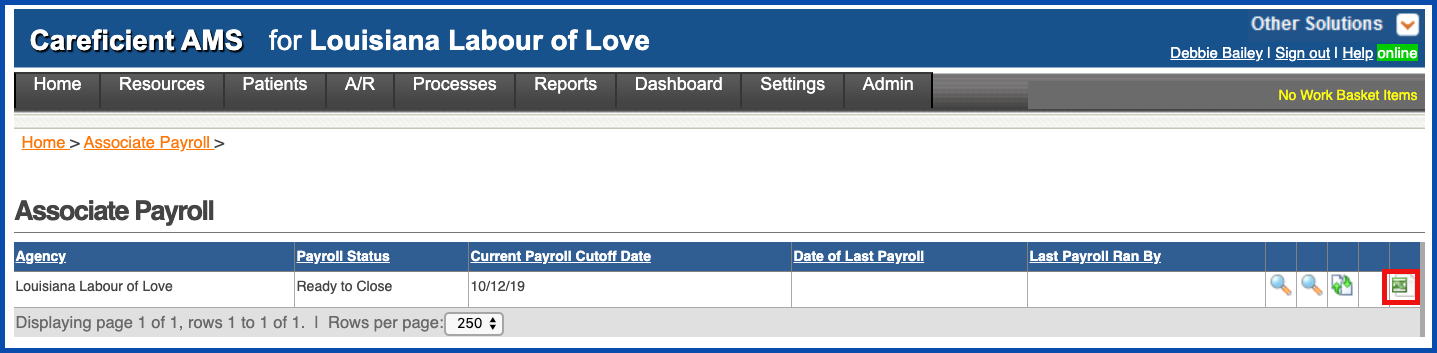

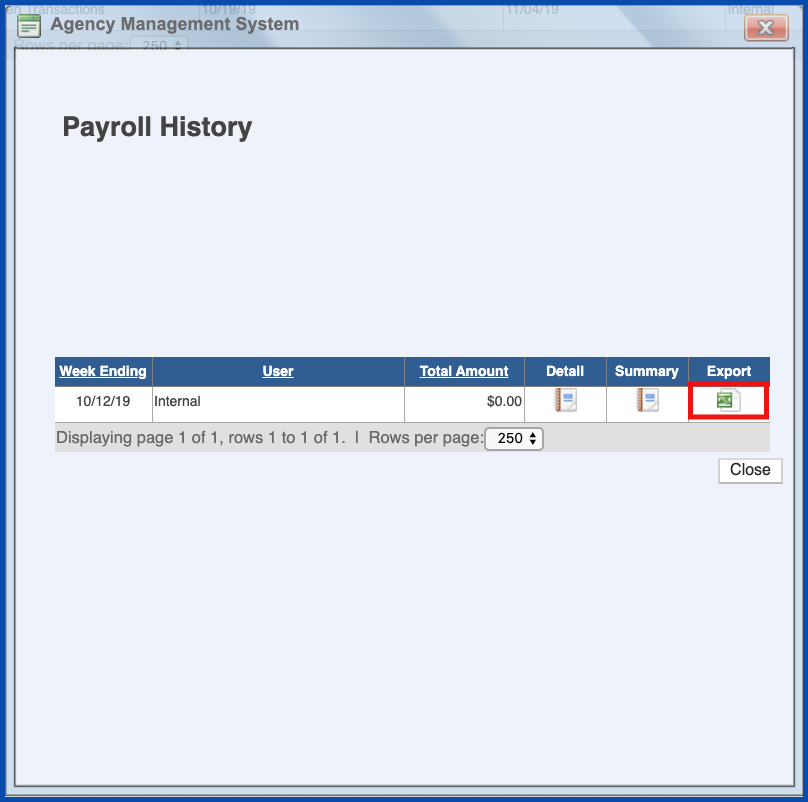

You can export the Payroll Data File prior to closing payroll by clicking on the Export Data File Icon.

Preview of Export Data File

The Export Data File includes:

- Agency Name

- Payroll Week-ending Date

- Payroll Processing Date

- Identifier

- Last Name

- First Name

- Earnings Code

- Service Code

- Service Description

- Service Date

- Actual Time In

- Actual Time Out

- Travel Time In

- Travel Time Out

- Travel Miles

- Pay Units

- Pay Rate

- Pay Amount

- Payroll Tax Code

- Deduction Description

- Deduction Amount

- Performed At

CLOSE PAYROLL (Top)

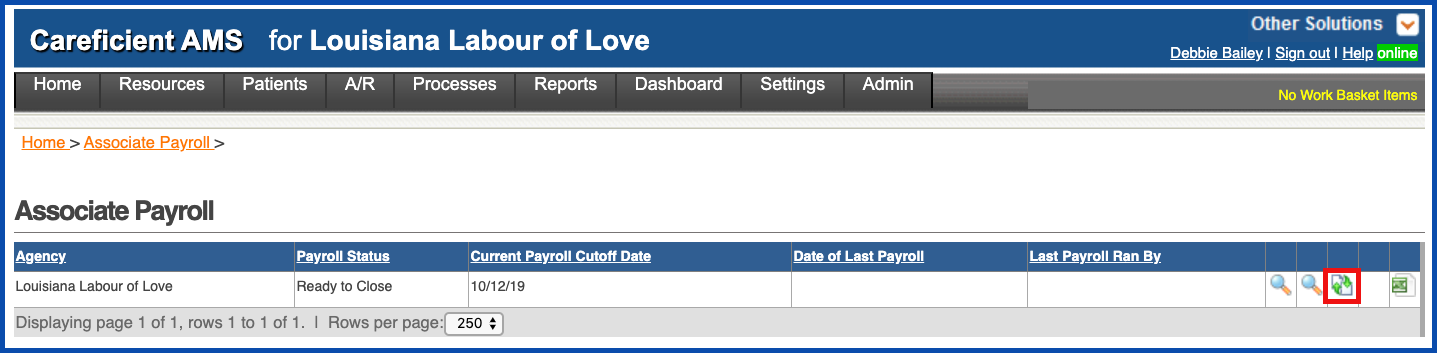

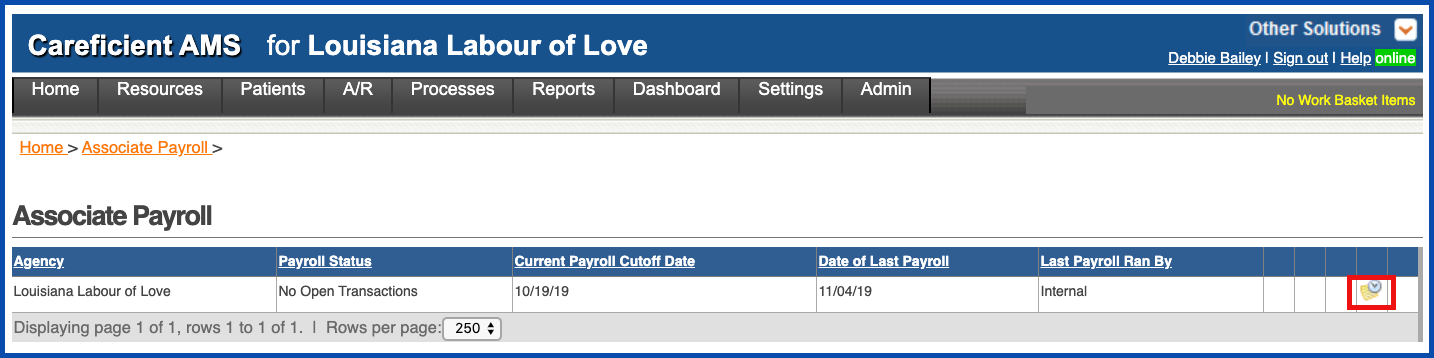

To close payroll, click on the Close Payroll icon.

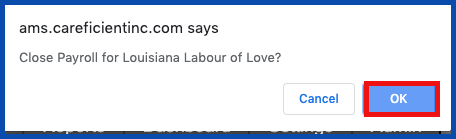

You will be asked if you are sure you want close payroll. Click "OK" to confirm.

.

.

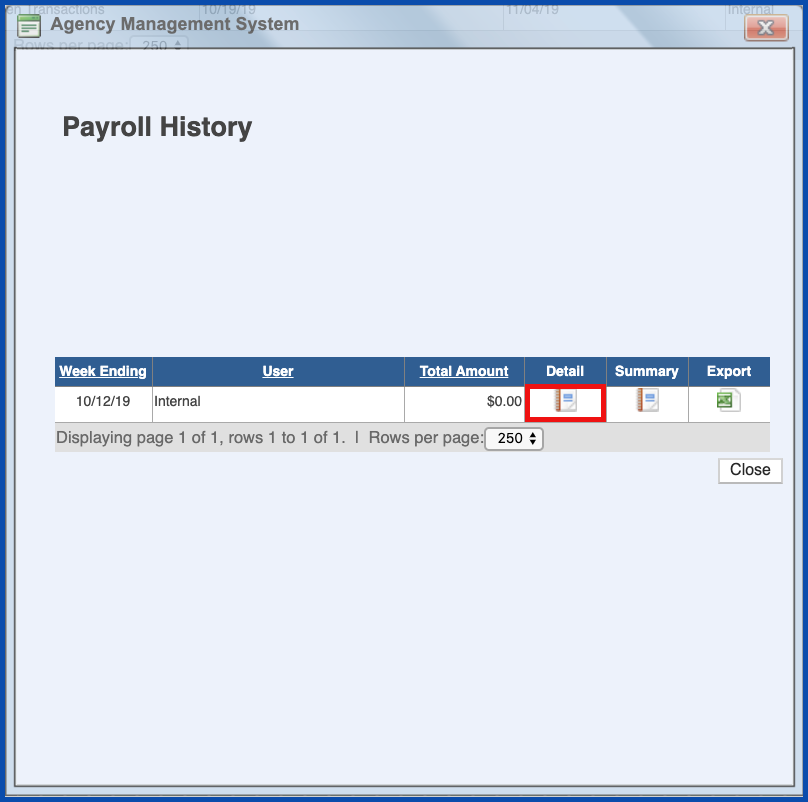

If you want to look at payroll history for any payroll that has been closed, the View Payroll History icon on the Payroll Report is a link to the Payroll History page.

The Payroll History page is in chronological order by week-ending date. It displays the name of the individual who closed the payroll process for that cycle as well as the total amount of the payroll for that time period.

REPORTS (Top)

To view the Payroll transactions Detail Report, click on the Payroll Detail Report icon.

Payroll Transactions Detail Report (PDF) includes:

- Cutoff Date

- Associate

- Units

- Rate

- Total Pay

- Patient

- Service

- Service Date

- Actual Time

- Duration

- Travel Miles

- Travel Duration

- Agency Name

- Total for all Associates in Units

- Total for all Associates in Total Pay

Payroll Summary Report (PDF) includes:

- Cutoff Date

- Associate

- Pay Units

- Pay Rate

- Amount

- Travel miles

- Travel Duration

- Total for all Associates in Pay Units

- Total for all Associates in Amount

- Total for all Associates in Travel Miles

- Total for all Associates in Travel Duration

Payroll (Spreadsheet) includes:

- Agency Name

- Payroll Week-ending Date

- Payroll Processing Date

- Identifier

- Last Name

- First Name

- Earnings Code

- Service Code

- Service Description

- Service Date

- Actual Time In

- Actual Time Out

- Travel Time In

- Travel Time Out

- Travel Miles

- Pay Units

- Pay Rate

- Pay Amount

- Payroll Tax Code

- Deduction Description

- Deduction Amount

- Performed At